Corporate Tax & Vat Advisory For UAE

Local UAE Expertise

One Partner for All Your Needs

Compliance with Confidence

Corporate Tax Planning, Compliance & VAT Advisory in Dubai & Across UAE

The business tax process in the UAE is very difficult; we are here to make it easy for you. Our expert in Dubai handles tax and VAT services in the right way for you. We provide complete Corporate Tax Services in UAE, handling it all so that you can focus on your growth.

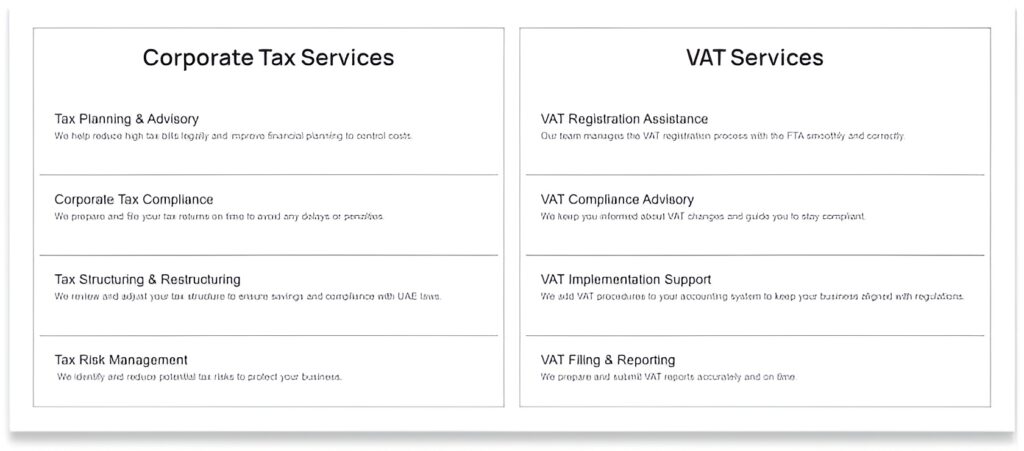

Corporate Tax Services

Tax Planning & Advisory

We help reduce high tax bills legally and improve financial planning to control costs.

Corporate Tax Compliance

We prepare and file your tax returns on time to avoid any delays or penalties.

Tax Structuring & Restructuring

We review and adjust your tax structure to ensure savings and compliance with UAE laws.

Tax Risk Management

We identify and reduce potential tax risks to protect your business.

VAT Services

VAT Registration Assistance

Our team manages the VAT registration process with the FTA smoothly and correctly.

VAT Compliance Advisory

We keep you informed about VAT changes and guide you to stay compliant.

VAT Implementation Support

We add VAT procedures to your accounting system to keep your business aligned with regulations.

VAT Filing & Reporting

We prepare and submit VAT reports accurately and on time.

Corporate Tax Rules & Regulations in UAE

Corporate Tax was introduced in 2023 for the first time. The main purpose is to create a fair and transparent tax system for all businesses. The standard rate is 9% on profits over AED 375,000. However, below this amount it remains tax-free. Missing any deadline or incorrect filing can lead to penalties that start from AED 10,000…

Mandatory Corporate Tax Registration

Businesses earning more than AED 375,000 must register with the Federal Tax Authority(FTA). We handle the registration process to save you time. We make sure to correct it without stress

Accurate Financial Record keeping

A Proper and clear financial record is required by UAE law. It helps to avoid problems during an audit. We ensure to maintain and organize all essential documents for you…

Transfer Pricing Compliance

If your company is involved in cross-border transactions, it must follow transfer pricing rules to ensure fair and transparent pricing. We review and organize…

Corporate Tax Filing & Payment

Companies Corporate Tax returns and pay any tax due within nine months after the financial year ends. We manage your payments on time and ensure everything matches FTA rules.

Penalties for Non-Compliance

late filing, wrong reporting, and missing documents can result in penalties, a business audit, or even frozen accounts. We help you minimize these risks completely.

Why Businesses Need Tax & VAT Advisory in Dubai

UAE tax rules are very confusing for a new startup or even an established business. Our Corporate Tax & VAT Advisory in Dubai helps you to stay compliant, save money, and run your business smoothly with peace…

Avoid Penalties for Non-Compliance

Missing any deadline or wrong filing can cost businesses thousands of fines. We ensure that your tax and VAT files always stay accurate and submitted…

Improve Cash Flow & Profitability

A Smart tax plan means more money will stay in your business. Our professionals find the legal way to minimize the tax of your business and improve overall cash flow.

Navigate Complex UAE Tax Laws

The UAE Tax system is very complicated. We make every easy to understand for all business types. We handle everything so your stay is compliant…

Stay Updated with Evolving Tax Regulations

You must stay updated with the UAE’s changing Tax rules. We keep track of everything from FTA and make sure your business always stays compliant.

Gain Expert Financial Strategies

You must stay updated with the UAE’s changing Tax rules. We keep track of everything from FTA and make sure your business always stays compliant.

PORTFOLIO

Our Other Services

At SkywayCSP, we do more than just handle tax. We offer complete support for UAE businesses. It helps you to grow, work smoothly, and stay fully compliant. No matter which stage your business is in, we are here to make things easier and faster for you.

Trade and Working Capital

in UAE

Trading companies have to face delays due to limited capital. We connect you with a reliable trade finance solution that keeps running without financial stress.

SME Working Capital & Business Finance

A Cash flow gap can hold your business. Our finance expert provides a solution to keep operations running smoothly by accessing quick, flexible funding.

Mortgage Finance Solutions

Property loans are complicated and filled with hidden conditions. We guide you to affordable property financing that fits with business needs.

Corporate Financing / Leasing Solution

Many businesses need funding to expand, but they have to face strict requirements. We help in selecting the right financing and leasing plans that meet your business needs.

Office Management

Managing daily office tasks is key to achieving bigger goals. We streamline your office setup and administration so that your team can only focus on business growth.

Bank Guarantees

It is not easy in the UAE to win a contract without any solid financial proof. We provide secure bank guarantee solutions to build trust with your clients.

Testmonial

Posted onTrustindex verifies that the original source of the review is Google. Our Cavendish Rd Body Corporate has been managed by Skyway for over 15 years. In that time we have been impressed by the professionalism and communication we have received from them. Skyway respond swiftly via email and take action promptly to remediate any issues that come up onsite. They have lead us through some difficult insurance matters and managed a successful outcome for our owners. The financial transparency is appreciated and the budgets are clear - we feel our funds are well managed and in safe hands. I would highly recommend the team at Skyway Body CorporatePosted onTrustindex verifies that the original source of the review is Google. Have been dealing with them for over 15 years and it turned out they waste a lot of tenant’s money (by wrong quoting) and if they really dislike you they play you out between other landlords and subcontractors by hissing behind your back and implement the stonewalling act by obtuse behaviour towards you. No they are not the kind of people we would deal with if we had the choice, unfortunately.Posted onTrustindex verifies that the original source of the review is Google. Poor communication with wrong information. Slow to address issues. Disrespectful and unresponsive.Posted onTrustindex verifies that the original source of the review is Google. Not very proactive dealing with maintenance and insurance issues. Tend to ask the homeowner to do most of the work. Which isn't great when they are elderly. Wouldn't recommend them other than for running the admin.

Why Choose SkywayCSP for Corporate Tax & VAT Advisory

At SkywayCSP, we simplify the Tax and VAT structure in the UAE. With strong experience in the UAE, we know how to keep your business compliant and secure. Our team works fast, charges…

Local UAE Expertise

We deeply know the UAE tax laws. Our local expert guides you in the right way. We make sure you will follow every rule and avail all benefits.

One Partner for All Your Needs

We deal with everything from accounting to tax filing. You do not need to go to different places.

Transparent Pricing

You must always know what<br> you are paying for. We clear everything and provide budget-friendly rates….

Quick Process

We ensure that everything is handled through the proper channels and avoid wasting time. From…

Compliance with Confidence

Our experts make you worry-free about fines and mistakes. We follow each FTA approval process…

At Skyways UAE, we help entrepreneurs and investors establish and grow their businesses with confidence. Our goal is to simplify the setup process, provide clear guidance, and open doors to new business opportunities across the UAE.